U.S. B2B Exhibition Industry Posts Double-Digit, Year-Over-Year Growth in Q2

The Center for Exhibition Industry Research (CEIR) reports the U.S. business-to-business (B2B) exhibition industry experienced a robust rebound, with continued improvement, during Q2 2023. The CEIR Total Index, which serves as a measure of overall exhibition performance, has surged by 21.8% compared to the same period a year ago.

“CEIR research has documented an intent to return to face-to-face engagement at B2B exhibitions, and CEIR Index quarterly results continue to document the recovery is in progress,” said CEIR CEO Cathy Breden. “Each quarter, the Index is showing that more business professionals and exhibitors are coming back to the B2B exhibitions channel to meet their marketing, sales and business information needs.”

TSNN has reviewed the data and curated the top highlights. To provide further context into Q2 industry performance, check out our recent articles on some of the best performing shows and companies during Q2.

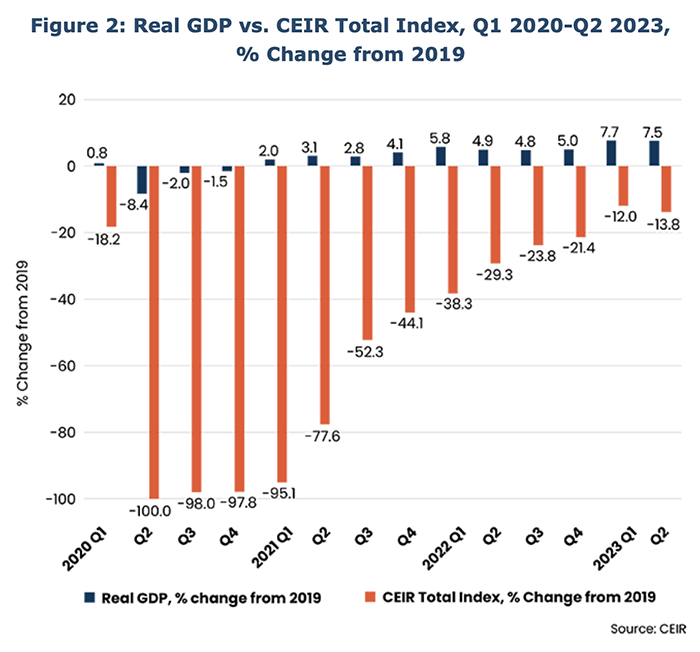

U.S. GDP and the CEIR Total Index

The performance of the U.S. economy has shown positive signs, with a 7.6% increase in real (inflation-adjusted) GDP from Q2 2019 to Q2 2023. On a seasonally-adjusted annual rate (SAAR) basis, real GDP experienced a moderate increase of 2.1% in Q2 2023. This growth primarily resulted from increased consumer spending, nonresidential fixed investment and government spending at all levels, partially offset by decreases in exports, residential fixed investment and private inventory investment.

Moreover, the recovery in services industries has gained momentum after initially lagging behind. In Q2 2023, real spending on consumer services exceeded Q4 2019 levels by 5.4%, a positive sign for consumer services-related exhibitions.

Related: Post-show Recap: Las Vegas and Atlanta Home and Gift Markets Deliver Sizzling Summer Editions

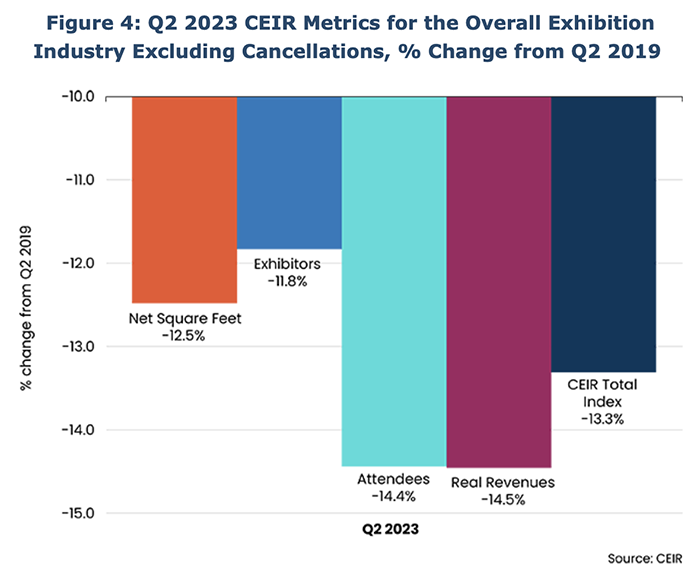

Metrics for the Overall Exhibition Industry

Among the four key metrics — Exhibitors, Net Square Feet (NSF), Attendees and Real Revenues — exhibitors have posted the strongest recovery, only 11.8% below Q2 2019 levels. NSF follows with a 12.5% decline, while Attendees and Real Revenues are slightly lower, with declines of 14.4% and 14.5%, respectively. High inflation and low nominal revenue levels have impacted the value of exhibition income.

Q2 2023 Exhibition Industry Performance

The Q2 2023 results indicate a continuing but uneven recovery in the exhibition industry. Among completed events, 22.9% have surpassed their pre-pandemic levels, nearly double the percentage from Q2 2022 when only 11.7% of events achieved this milestone. Some organizers have launched new shows, expanded existing ones or altered their timing to adapt to changing conditions. When excluding cancellations, the performance of events in Q2 2023 is only down by 13.3% compared to 2019, a significant improvement from the 25.7% decline in Q2 2022.

Related: Viad Corp., Parent of GES and Spiro, Reports Slight Uptick in Q2 Revenues

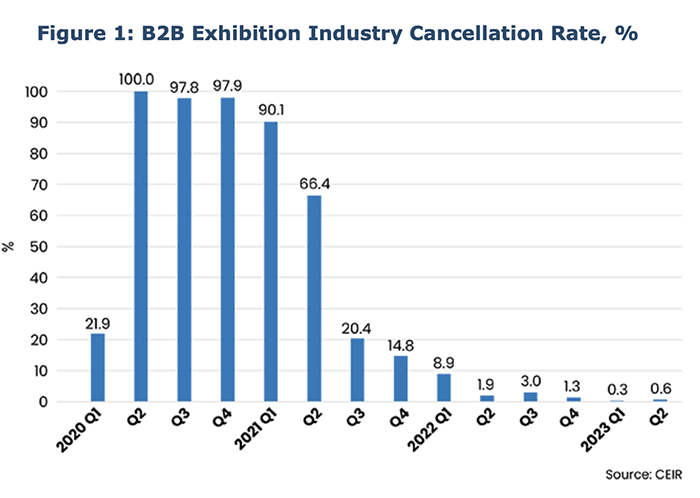

Cancellation rates then and now

Notably, the cancellation rate for physical in-person events remained exceptionally low at 0.6% in Q2 2023, showing dramatic progress from 66.4% in Q2 2021 and 1.9% in Q2 2022.

The remarkable decline in cancellations, along with improvements in metrics for completed events, has propelled the Q2 2023 Index results. However, when compared to Q2 2019, the Index is still 13.8% lower, although this represents a substantial improvement compared to the 77.6% decline in Q2 2021 and the 29.3% decline in Q2 2022.

Related: InfoComm Celebrates Innovation and Evolution, Strong Uptick in Attendees and Exhibitors

Insights on a Potential Recession

While concerns about a recession among U.S. regional banks have diminished, the possibility of a recession within the next 12 months remains at 45%-50%. Factors contributing to this include tighter financial conditions and unpredictable shocks. However, a potential recession is expected to be short and shallow due to factors such as low household debt service payments, pent-up consumer demand for services, ample corporate cash reserves and advancements in technology adoption.

Related: Summer Fancy Food Show in NYC Reports Double-Digit Growth in Exhibiting Companies and Registrations

B2B Exhibitions Recovery

Q4 2023 through the first half of 2024 are expected to be challenging as the economy slows down, but positive momentum is expected to continue for face-to-face trade shows. Widespread B2B exhibition cancellations due to COVID are no longer a concern, and the industry is gradually returning to pre-pandemic schedules and performance levels. A full industry recovery is projected for 2024.

Sector-Specific Performance

Among the 14 industry sectors monitored by CEIR, the Transportation, Industrial/Heavy Machinery and Finished Business Inputs sectors are expected to perform better in 2024 and 2025, while the Consumer Goods and Retail Trade and Education sectors are projected to lag behind the overall exhibition industry.

Main image: Total registrants for InfoComm 2023 reached 36,639, with the show welcoming 29,325 verified attendees from 115 countries.

Don’t miss any event-related news: Sign up for our weekly e-newsletter HERE, listen to our latest podcast HERE and engage with us on Twitter, Facebook and LinkedIn!

Add new comment