UFI Research Reveals Global Exhibition Industry Close to Pre-Pandemic Levels in 2023

The exhibition industry has made a significant recovery in 2023 and has reached pre-pandemic levels in many parts of the world, according to UFI, the Global Association of the Exhibition Industry’s 2023 Global Exhibition Barometer, a biannual research report offering comprehensive insights into the current state of the exhibition industry, including its post-pandemic recovery and emerging trends and challenges.

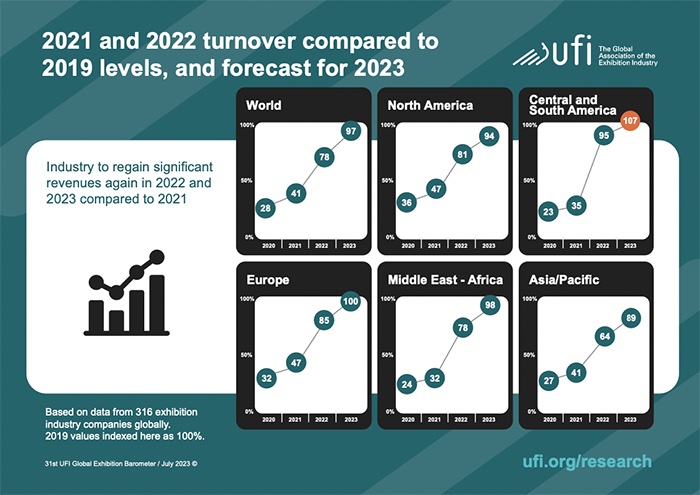

In 2023, the exhibition industry revenues are expected to reach 97% of the 2019 levels on average globally, according to the report. In the first half of 2023, 79% of companies reported “normal activity,” which increased to almost 90% for most months in the second half of the year.

In 2022, revenues reached 78% of the 2019 levels, indicating a significant bounce back of business. This recovery has exceeded expectations from six months ago, when exhibition companies projected reaching only 91% of the 2019 levels.

“After China’s reopening early this year, the pandemic is now completely in our industry’s rearview mirror, as we are tracking levels of business activities already higher than in 2019 in a growing number of markets,” said Kai Hattendorf, managing director and CEO at UFI. “Creating a ‘new normal’ in front of us, the industry is evolving both on digital products and services and on sustainability. New technologies like generative artificial intelligence applications are being explored, while staffing remains a key concern.”

Featuring statistical data gathered via survey, concluded in July 2023, the 31st edition of the report includes insights from 351 companies in 61 countries and regions, offering a comprehensive view of the global exhibition landscape. The study provides dedicated profiles for 19 markets and regions (Argentina, Australia, Brazil, China, Colombia, France, Germany, Greece, India, Italy, Malaysia, Mexico, Saudi Arabia, South Africa, Spain, Thailand, the UAE, the UK and the U.S.) as well as five additional aggregated regional zones.

The countries expected to experience the highest levels of normal activity in the second half of 2023 are Australia (97%), the UK (95%), Italy and the U.S. (94%), Brazil (92%), and Argentina (90%). Notably, China has seen a significant uptick in expectations, with 74% of companies anticipating normal activity compared to only 29% six months ago, according to the report.

In terms of operating profits compared to 2019 levels, around half of the companies are declaring an increase or stable level for 2022, and their proportion is increasing to 7 out of 10 for 2023, indicating a positive trend. Additionally, only 2% of respondents globally expect a loss for 2023, a notable improvement compared to 11% reported for 2022. Germany (11%) and Colombia (10%) reported the highest proportion of companies expecting a loss in 2023.

The report also highlights the most pressing issues facing the industry, with the top two concerns identified by exhibiting companies as changing customer expectations and staffing. Around 68% of companies consider changing customer expectations as the most impactful element for their business development in the next five years, followed by staffing, which garnered 54% of responses. Digitalization is also expected to significantly influence business development, as anticipated by 45% of respondents, particularly in Spain, Argentina, Colombia and Malaysia.

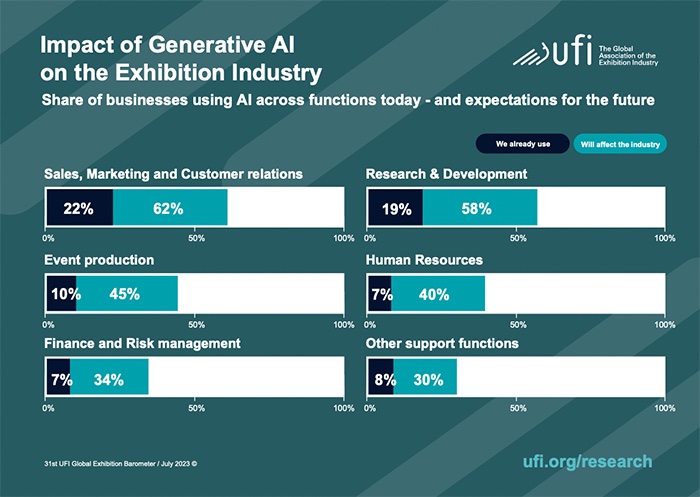

The report sheds light on the impact of generative AI on the exhibition industry, citing that Generative AI applications, such as ChatGPT, are already widely used across various business functions. Globally, 62% of respondents expect sales, marketing and customer relations to be most affected by AI development, followed by research and development (58%) and event production (45%). Interestingly, these are the areas where generative AI applications are already widely used by respondents, with 22%, 19% and 10% utilization, respectively. Meanwhile, Europe appears to have a lower prevalence of AI usage compared to other regions.

Overall, the findings of the Global Exhibition Barometer indicate a positive outlook for the exhibition industry. The exhibition sector has recovered well from the impact of the pandemic, with revenues approaching pre-pandemic levels. However, companies are now focusing on adapting to changing customer expectations and addressing staffing challenges, and the integration of AI technologies, particularly generative AI applications, is also becoming increasingly prevalent in various aspects of the industry.

The next UFI Global Exhibition Barometer survey will be conducted in January 2024. To download the full 2023 report, go here.

Don’t miss any event-related news: Sign up for our weekly e-newsletter HERE, listen to our latest podcast HERE and engage with us on Twitter, Facebook and LinkedIn!

Add new comment