Informa Reports Double-Digit Revenue Growth in 2023 and Merger With TechTarget

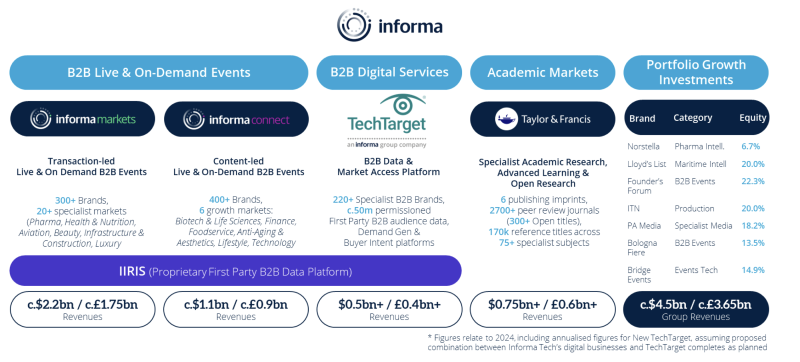

Informa, the international B2B events, digital services and academic markets company (owner of TSNN, ENN and Corporate Event News), reported a 30% increase in underlying revenue for the full-year 2023 and the merger of Informa Tech’s digital businesses with U.S.-based TechTarget.

During an investor presentation on Jan. 10, Informa Group Chief Executive Stephen A. Carter said the company’s 2024 guidance targets high single-digit underlying revenue growth, with reported revenue of £3,425m-£3,475m ($4,332m-$4,395m) and adjusted operating profit of £945m-£965m ($1,195m-$1,220m).

By the numbers: Subject to audit, Informa expects to report 2023 underlying revenue growth of about 30%, with reported revenue of £3,165m+ ($4,030m), adjusted operating profit of approx. £845m ($1,076m) and free cash flow of £600m+ ($764m).

Looking back: In 2023, Informa acquired Winsight, Tarsus, HIMMS and Canalys. In July, Events Investment Fund (EIF) acquired a stake in Tahaluf, the Saudi Arabian live events company created through a strategic joint venture between the Saudi Federation for Cybersecurity, Programming and Drones (SAFCSP) and Informa.

Why it matters: After COVID shut down the in-person events in 2020, Informa has rebounded and reported higher revenues than 2019.

Related: THREE GLOBAL TRADE SHOW PRODUCERS POST DOUBLE-DIGIT REVENUE GROWTH

Trade shows and event growth: Major live and on-demand brands, rich specialist B2B content and additional digital services are delivering volume and value growth across Informa Markets, Informa Connect and Informa Tech, leading to about 40% aggregate underlying revenue growth in 2023 and a target of high single-digit growth in 2024.

Looking ahead: 2024 guidance targets high single-digit underlying revenue growth, with reported revenue of £3,425m-£3,475m ($4,330m-$4,393m) and adjusted operating profit of £945m-£965m ($1,194m-$1,220m), excluding any effect of the proposed combination with TechTarget. High-growth B2B markets in 2024 include: pharma, healthcare, technology, health and nutrition, beauty and aviation, Carter said.

Read the full Informa release here.

Merger with TechTarget

During the investor presentation, Carter also announced Informa Tech’s digital businesses — which includes Industry Dive, Omdia (including Canalys), NetLine and its Digital Media Brands such as Information Week, Light Reading, AI Business — will combine with U.S.-listed TechTarget to create New TechTarget with annual sales of about $500m.

Deeper Dive: Headquartered and listed in the U.S.,TechTarget is a provider of data-driven B2B products to enterprise technology customers. It delivers new customers, influences purchasing decisions and drives revenue, based on buyer intelligence derived from its first-party B2B data. TechTarget estimates it will generate 2024 Revenues of about $235m and adjusted EBITDA of about $73m.

What they are saying: “Over the last three years, Informa has built a proprietary first-party data platform, IIRIS, and expanded our position in the B2B Digital Services market,” Carter said. “Now, through a majority shareholding in U.S.-listed TechTarget, we are positioning this business firmly where the customers and the value are.”

Looking ahead: New TechTarget will be U.S.-listed on Nasdaq (Ticker: TTGT) and led by Gary Nugent as CEO, who is also the current Informa Tech CEO. The New TechTarget will scale in segmented B2B audiences through a portfolio of more than 220 specialist B2B tech content brands and tech research business, Omdia.

Want to know more? Watch the full investor presentation here.

Add new comment